Diversifying Your Portfolio with Alternative Investments: Insights from Scott Tominaga

Adding alternative investments like real estate, hedge funds, private equity, and commodities to a diversified portfolio can greatly increase its defense against market fluctuations. Additionally, this approach can boost overall returns by accessing distinct opportunities and asset classes that don’t move in tandem with conventional stock and bond markets.

Scott Tominaga outlines the following strategies worth considering:

Strategy 1 – Understand alternative investments.

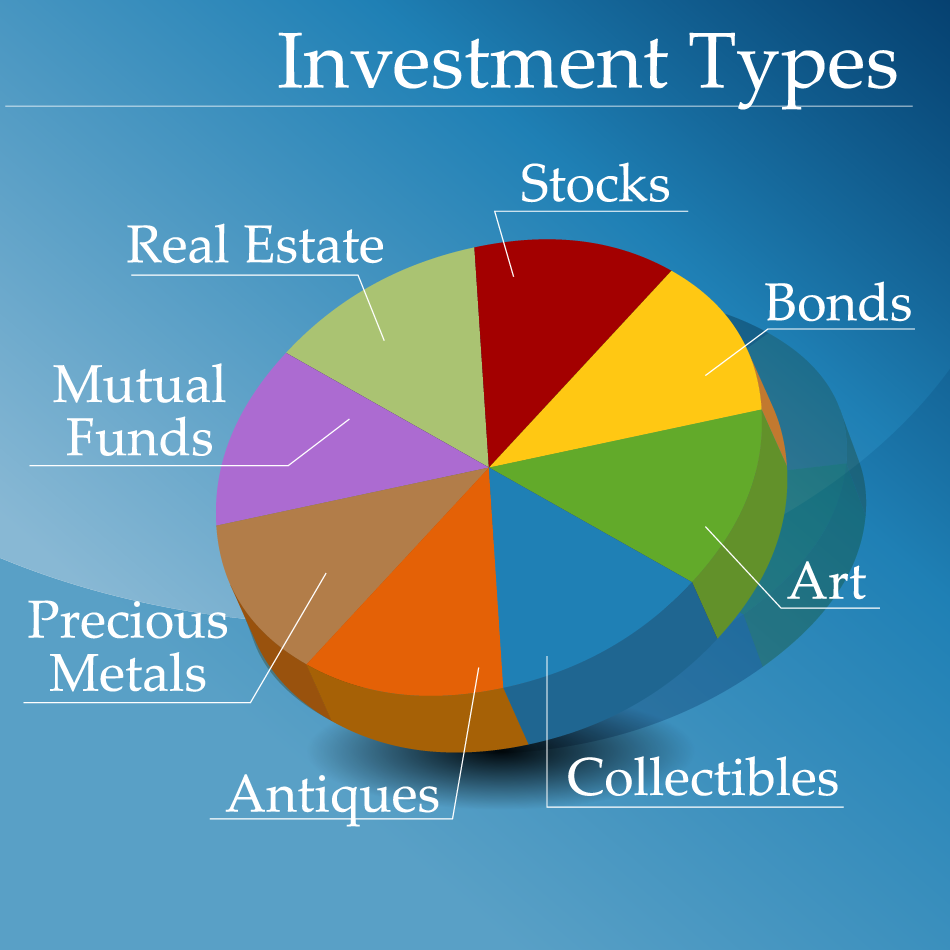

Alternative investments cover a broad spectrum of asset classes outside the conventional realms of stocks and bonds. This category includes various types of investments such as private equity, where investors directly invest in private companies; venture capital, which involves funding startups and early-stage companies; real estate, encompassing both commercial and residential properties; hedge funds, which are pooled investment funds that employ different strategies to earn active returns for their investors; and commodities, which include physical goods like gold, oil, and agricultural products. Unlike traditional investments, these alternative assets frequently exhibit unique behavior that does not closely correlate with the stock market’s fluctuations. This distinctive characteristic can offer investors significant advantages by diversifying their investment portfolios, potentially reducing risk and enhancing returns over time.

Strategy 2 – Diversify with private equity and venture capital.

Private equity and venture capital provide investors with the opportunity to gain exposure to private companies and startups, sectors not typically accessible through public markets. These forms of investment can yield substantial growth and returns, often outperforming traditional investments. However, they carry a higher risk due to the inherent volatility and unpredictability of startups and private markets. Investors in these areas must be prepared for the possibility of significant fluctuations in their investment value.

Strategy 3 – Allocate a portion of your portfolio.

Financial experts often suggest that for optimal diversification and potential returns, investors should allocate 10% to 20% of their investment portfolio to alternative investments. These can include assets such as real estate, commodities, hedge funds, and private equity. The idea is to not only enhance potential returns but also to reduce risk through diversification. Scott Tominaga says when deciding on the appropriate allocation, it’s crucial to take into account your specific investment goals, how much risk you’re comfortable taking on, and your investment timeframe. Tailoring your portfolio to include a thoughtful mix of traditional and alternative investments can significantly impact its overall performance and resilience against market volatility.

Strategy 4 – Explore different strategies.

Equity market-neutral, event-driven, options trading, relative value arbitrage, and multistrategy represent prevalent alternative investment strategies. These approaches aim to refine, diversify, or altogether mitigate conventional market risks. While some strategies target absolute returns, others serve as hedges against fluctuations in the equity market.

Strategy 5 – Monitor performance and correlations.

Thoroughly evaluate how alternative investments, such as real estate, commodities, and hedge funds, perform during market downturns. This involves understanding their correlations with traditional asset classes like stocks and bonds. By doing so, you can gain insights into how these alternative assets behave in contrast to more conventional investments during times of economic stress. It’s crucial to adjust your investment allocation based on changing market conditions to optimize your portfolio’s performance and mitigate risk.

Strategy 6 – Research and due diligence.

Before diversifying your portfolio with alternative investments, it’s crucial to conduct in-depth research. Evaluate potential fees, assess the liquidity of these investments to ensure they fit with your financial strategy, and carefully consider the expertise and track record of the fund managers involved. This comprehensive approach will help ensure that you make well-informed decisions that align with your investment goals.

Scott Tominaga emphasizes that incorporating alternative investments into your portfolio introduces a layer of complexity, but with careful selection, these investments can be instrumental in achieving diversification. This strategic choice can ultimately contribute to enhancing your portfolio’s long-term returns.

However, it’s important to note that alternative investments come with their own set of risks and considerations. Therefore, individuals should seek the guidance of a professional financial advisor. This step is crucial to ensure that your investment strategy is meticulously tailored to align with your unique financial goals and risk tolerance levels, enabling you to make informed decisions that are best suited to your financial well-being.

Scott Tominaga earned his degree in Business Finance from Arizona State University in 1988. An experienced professional in the hedge fund and financial services industry, his skills involve expertise in middle and back-office accounting, compliance, and administrative functions within financial services firms. For more articles on finance and investment, visit this blog.

Leave a Reply